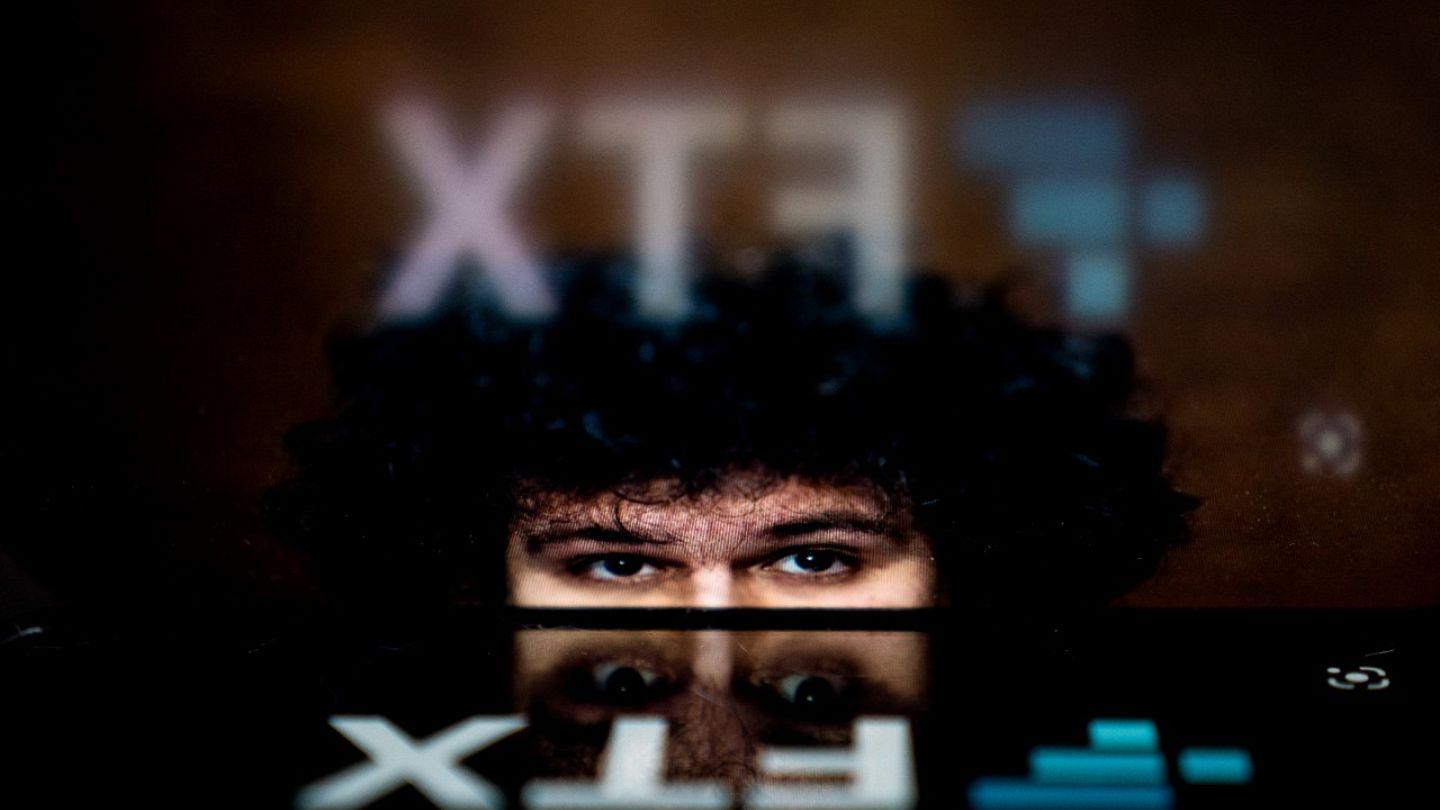

FTX collapse

FTX was a huge player. The collapse of FTX which has filed for bankruptcy Friday after rocking an already-reeling crypto market was just as shocking he said.

The digital assets market has been rocked by the near-collapse of one of the worlds biggest cryptocurrency exchanges FTX.

. The swift collapse of cryptocurrency exchange FTX sent more shockwaves through the crypto world on Thursday with authorities now investigating the firm for potential securities. But its clear that Alameda Research used FTT to make speculative bets on other cryptocurrencies. This meant a fall in FTTs value would hurt both.

FTXs collapse has resulted in 2 billion in client money now missing. The swift collapse of the cryptocurrency exchange FTX sent more shockwaves through the crypto world on Thursday with authorities now investigating the firm for potential. Binance CEO Changpeng Zhao said the cryptocurrency exchange has seen only a slight uptick in withdrawals and is operating normally despite a fall in digital asset prices after.

8 according to internal messages seen by Reuters. Many supporters of crypto oppose government oversight. Alameda held billions of dollars worth of FTXs own cryptocurrency FTT and had been using it as collateral in further loans.

See FTX has always had massive ambitions besides making money off of transaction fees and interest income. FTX is on the brink of collapse as chief Sam Bankman-Fried races to secure billions of dollars to salvage his empire after Binance ditched an eleventh-hour rescue of one of the worlds biggest. The collapse of Sam Bankman-Frieds crypto empire has sparked a vast global investigation with dozens of authorities circling the company as lawyers warn there could be 1.

Nov 13 Reuters - The collapse of FTX is the subject of scrutiny from investigators in the Bahamas who are looking at whether any criminal misconduct occurred the Royal. When Samuel realized that FTX had suspended withdrawals on November 8 his hands began to tremble. The digital assets market has been rocked by the near-collapse of one of the worlds biggest cryptocurrency exchanges FTX.

Its collapse was preceded by the decision to. FTX backed by elite investors like BlackRock and Sequoia Capital rapidly became one of the biggest crypto exchanges in the world. John Reed Stark lecturing fellow at Duke University Law School and Neel Maitra partner at Wilson.

One of those critics was Binance founder. The digital assets industry has been shaken by the near-collapse of Sam Bankman-Frieds FTX one of the largest crypto exchanges which clinched a rescue deal with arch-rival. The 25000 in assets he keeps with the crypto exchange equivalent.

From the naming rights for an NBA. FTX fell apart quickly and there is still a lot to learn about its stunning collapse. Arena to patches on MLB.

November 9 2022 843 AM 3 min read. On Tuesday FTX struck a bailout deal with larger. According to CoinGecko as of this morning FTX was the fourth-largest exchange by volume.

The stunning collapse of the cryptocurrency platform FTX is being investigated by federal prosecutors in Manhattan people familiar with the probe said. Umpires uniforms FTXs collapse puts sponsorship deals worth hundreds of millions of. Now FTXs collapse may have helped make a case for stricter regulation.

At least 1 billion of customer funds and possibly as much as 2 billion have gone missing. The exchange saw 6 billion in withdrawals in the 72 hours before things reached a head on the morning of Nov. FTX collapse worse than Theranos worse than Madoff expert says.

And the moment they set up their exchange they also. It also underscores a critical. Sam Bankman-Fried was a huge donor during the midterm.